2021 ev charger tax credit

While the credit will look similar to the credit that expired on December 31 2021 there are some key distinctions to pay attention to. Apply on or before July 31 2022.

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of.

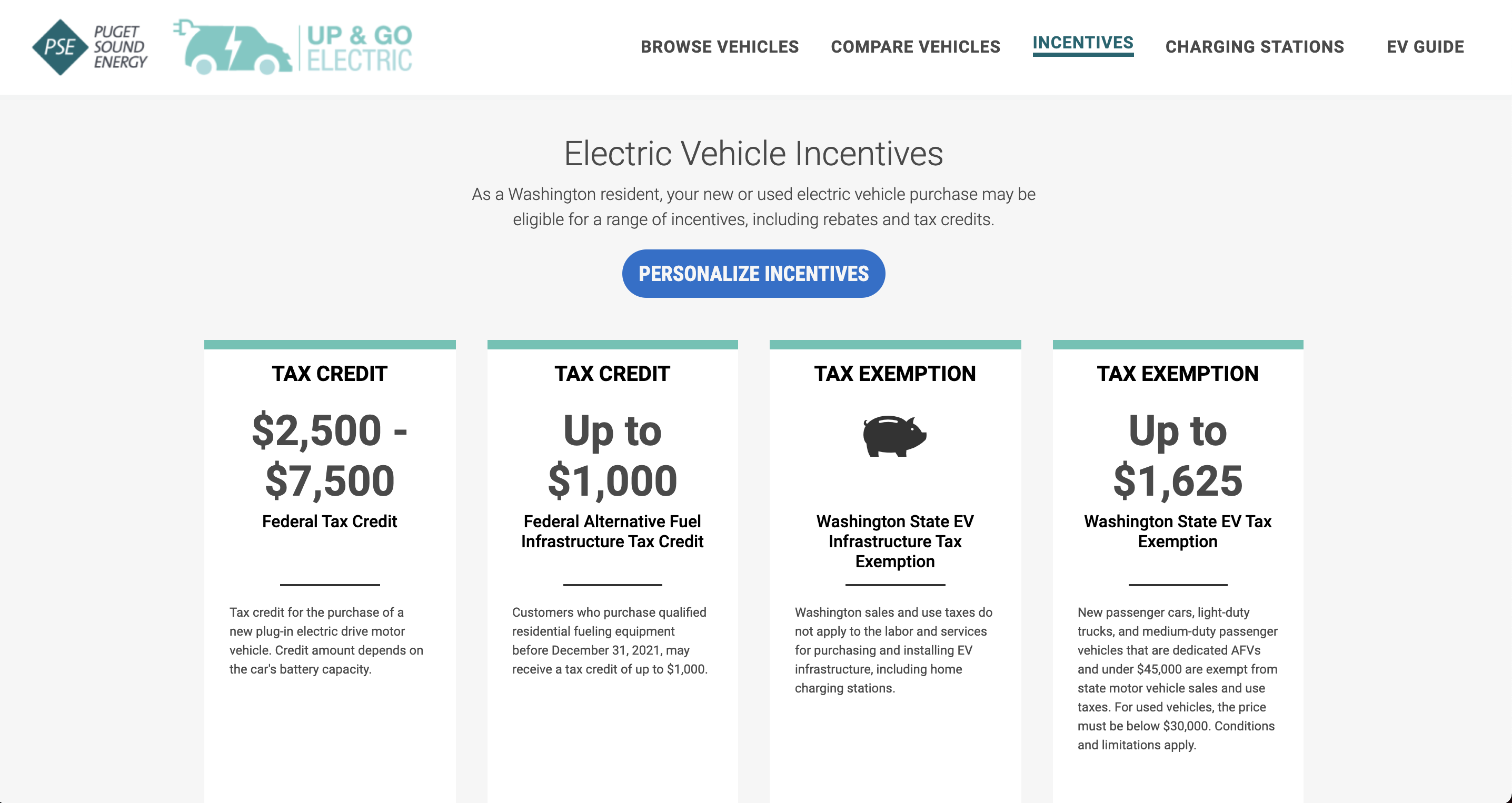

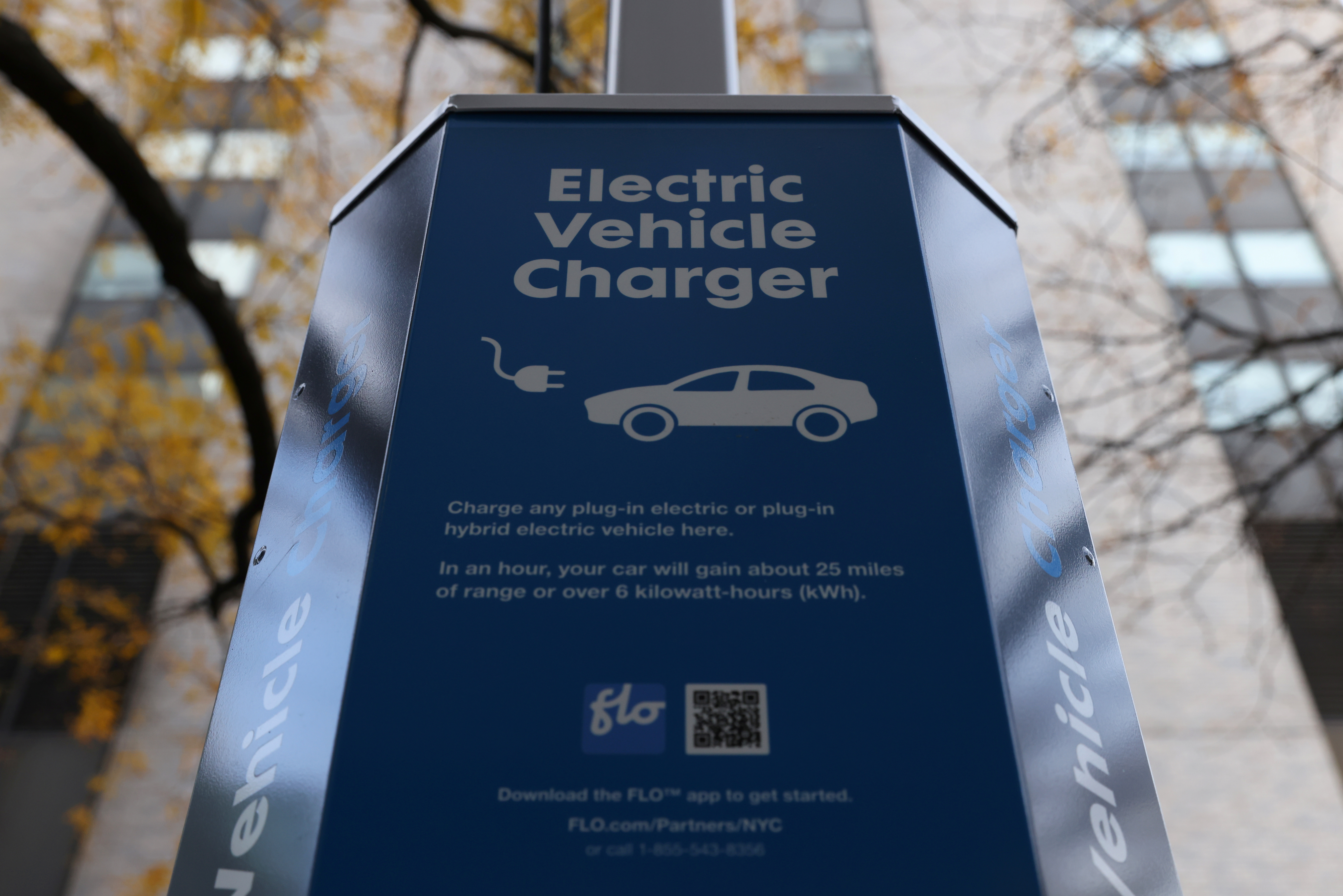

. You can receive a federal EV charger tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 100000. Commercial EV chargers tax credit. The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE.

2000 to 4500 for battery electric vehicles. Justin Herbert 450 Black Cracked Ice 2021 Illusions SP Los Angeles Chargers. 2021 and April 30 2022.

The amount of the credit will be 12000. This California EV rebate typically awards between 1000 and 3500 for plug-in hybrids. And 4500 to 7000 for fuel cell electric.

The credit attributable to depreciable property. The adjusted depreciable basis is 28000 which will then be depreciated over the next five years. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of.

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. 2021 Illusions Football Shining Stars Justin Herbert Los Angeles Chargers. 30 of total installation cost up to 30000.

Electric Vehicles Solar and Energy Storage. Up to 1000 state tax credit Local and Utility Incentives. The total installation cost includes hardware shipping and installation fees but not permit or.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a. After having expired at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back. So instead of accelerating depreciation.

Reduced Vehicle License Tax and carpool lane access. Funds will be awarded on a first-come first. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

Technically referred to as the Alternative. It covers 30 of the costs with a maximum 1000 credit for residents and. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. The new Section 30C tax credit provides a.

Here S What Is And Isn T In The New Bipartisan Infrastructure Bill For Evs

U S Democrats Propose Dramatic Expansion Of Ev Tax Credits That Favors Big Three

Toyota Offers Free Ev Charging To Bz4x Buyers As Tax Credit Runs Out

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Xcel Energy Will Now Help Pay For An Electric Car Depending On Your Income Colorado Public Radio

Ev Charging Station Tax Credits Are Back Inflation Reduction Act Extension Of The Section 30c Tax Credit Blogs Renewable Energy Outlook Foley Lardner Llp

Will Tax Credits And Infrastructure Speed Adoption Of Electric Vehicles

The Power Of The Tax Credit For Buying An Electric Vehicle Mize Cpas Inc

How To Get The Federal Ev Charger Tax Credit Forbes Advisor

What To Know About The Complicated Tax Credit For Electric Cars Npr

How Do Electric Car Tax Credits Work Credit Karma

Electric Vehicles Charging Stations Lg E And Ku

How To Choose The Right Ev Charger For You Forbes Wheels

Massachusetts Charging Incentives Just Got Better

Tax Credit For Electric Vehicle Chargers Enel X Way

Residential Charging Station Tax Credit Evocharge

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

/cdn.vox-cdn.com/uploads/chorus_asset/file/23019312/1235384443.jpg)

Biden S 7 5 Billion Ev Charging Plan Will Require A Lot Of Patience The Verge